Market capitalization (AKA crypto market cap) can be a significant variable for financial exchange investors. In any case, it’s not exactly no different for crypto investors.

While securities exchange capitalization — the all out worth of an organization’s all out portions of stock — can help investors construct and keep a fair investment portfolio, specialists say those rules don’t precisely apply for crypto investors.

This is what crypto heatmap investors ought to realize about market cap, and how it ought to (or shouldn’t) factor into your procedure.

What Is Cryptocurrency Market Capitalization?

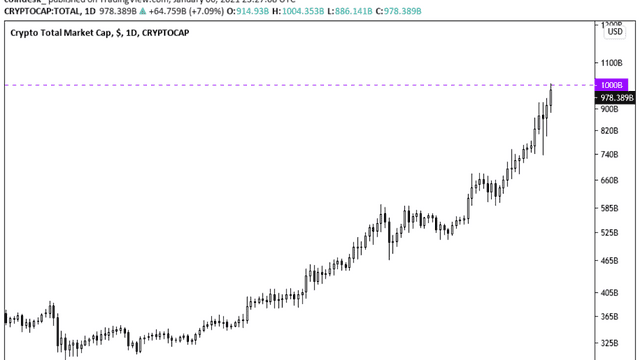

Crypto market capitalization is the complete worth of a cryptocurrency. Where financial exchange capitalization is determined by duplicating share cost times shares exceptional, crypto market capitalization is determined by increasing the cost of the cryptocurrency with the quantity of coins available for use.

For instance, Bitcoin’s market capitalization is found by duplicating the ongoing number of coins in presence — more than 18 billion — with Bitcoin’s cost at a given time.

As Bitcoin’s cost changes, which it does often, so too does its market capitalization. In the beyond couple of weeks, Bitcoin’s cost has been between around $45,000 to $55,000, which converts into a huge reach in market capitalization:

$45,000 x 18.8 million = $846 billion

$50,000 x 18.8 million = $940 billion

$55,000 x 18.8 million = $1.034 trillion

For correlation, this is the way Ethereum piles facing Bitcoin in market cap: At a cost of $3,000 and course of around 117 million, Ethereum has a market capitalization of about $351 billion. Despite the fact that there are a lot more Ethereum coins available for use, Bitcoin’s worth makes its market capitalization larger.

How Might Crypto Market Cap Affect Investors?

In the financial exchange, knowing an organization’s market capitalization groups it into an investment class: small cap, mid-cap, or large-cap. An investor could decide to partition their investment into these gatherings for various reasons, so realizing market cap is significant.

Market cap is frequently used to allude to how much an organization is worth, and this worth can be reflected in the fact that putting resources into the company is so hazardous. Large-cap stocks are in many cases safer, however more slow developing than mid-or small-cap stocks.

Be that as it may, cryptocurrency is new. So new, as a matter of fact, that these kinds of classes haven’t yet been framed. Furthermore, since specialists say you ought to adhere to Bitcoin and Ethereum, and not let crypto address over 5% of your complete portfolio, there is less need to utilize market cap in deciding investment choices.

Realizing cryptocurrency market cap may be fascinating on the off chance that you wish to know the extension or capability of a specific token, yet it ought not be as large a variable with your investing choices as it very well may be in the securities exchange.

With crypto, “It’s vital to perceive that it’s totally unique in relation to the securities exchange,” says Jully Alma-Taveras, the individual accounting master behind “‘Investing Latina”‘ on Instagram. “It’s something else altogether.”

While market capitalization has a more restricted application with crypto investing, there is one way it might possibly assist with directing the manner in which you invest in Bitcoin and Ethereum.

Step by Step Instructions To Use a Crypto Weighted Market Cap Strategy

A weighted market cap methodology can assist investors with night in the event that they are just investing in Bitcoin and Ethereum, says Jeremy Schneider, the individual budget master behind Personal Finance Club told us as of late.

A weighted market cap technique implies you put a corresponding investment into every resource in view of market cap. So in the event that you take the complete market capitalizations of both Bitcoin and Ethereum, partition out the rates every individual crypto holds in that aggregate, you’d wind up with around 71% Bitcoin and 29% Ethereum.

This approach can assist you with deciding how to invest $100 in the two greatest cryptocurrencies: You’d invest about $71 in Bitcoin and $29 in Ethereum.

While the specialists say you shouldn’t mess with other altcoins (whatever’s not Bitcoin), a similar way of thinking can in principle be utilized for anything you wish to incorporate into your portfolio.

Simply dispense the amount of an all out investment sum you wish to place into each coin in view of its relative market capitalization. At any rate, this guarantees you are placing a lot smaller sums in other cryptos, and larger sums in the somewhat more secure Bitcoin and Ethereum.

Order of Crypto Resources in Light of the Market Cap

There are four classifications utilized in market capitalization to arrange the worth degree of different resources on the cryptocurrency market.

These characterizations will make it simpler for you to contrast the complete worth of cryptocurrency and others, so you will actually want to settle on better choices for investment. Furthermore, this data will make perusing a cryptocurrency chart somewhat simpler.

Here Are the Four Market Capitalization Orders in Cryptocurrency:

Large-cap cryptocurrencies allude to cryptocurrencies with enormous market capitalizations and are generally viewed as protected crypto investments.

A cryptocurrency is viewed as a large-cap on the off chance that its market cap is more than 10 billion USD.

Large-Cap

Other than that, large-cap cryptocurrencies additionally have higher liquidity, which draws in additional investors than those with lower capitalizations. This implies that you can find these resources practically in each computerized resource trading stage.

Cryptocurrencies remembered for this class are Bitcoin and Ethereum (ETH).

Mid-Cap

Mid-cap cryptocurrencies have a market capitalization of 1-10 billion USD. Currencies ordered as mid-cap are for the most part considered to have undiscovered profit potential yet are higher-risk resources.

As a rule, mid-cap cryptocurrencies will generally show great execution in the long haul. By having it in your portfolio, mid-cap currencies can build your resource enhancement.

Be that as it may, not all mid-cap coins can possibly transform into large-cap resources.

Instances of currencies having a place with the mid-cap class incorporate Litecoin, Cardano, and Monero.

Small-Cap

Coins and tokens having a place with the small-cap cryptocurrencies are currencies with a market cap of around 100 million – 1 billion USD. Cryptocurrencies in this class are exceptionally unpredictable and thought about high-risk investments, despite the fact that they can possibly fill temporarily.

An illustration of the currencies in this class is Dogecoin.

Micro-Cap

Micro-cap resources are considered to have higher dangers contrasted with the currencies in the small-cap class.

By and large, currencies having a place with this class are new coins sent off by a gathering or mysterious gatherings with a market cap of under 50 million USD.

Conclusion

It’s additionally critical to recall that on the grounds that crypto costs vacillate so decisively, market capitalization is continually evolving. This vacillation — alongside the potential for the market to exit completely — is additionally why specialists suggest keeping any investment incredibly restricted, and just to invest what you’re OK with losing.

Let us know your thoughts in the comment section below and do not forget to visit trendingnewsbuzz for more mind-boggling updates.